Searching for your misplaced EIN verification letter, also known as the IRS 147c letter? You’re not alone. Many business owners and tax professionals need to request a replacement EIN confirmation document. Thankfully, retrieving your 147c letter from the IRS is a straightforward process.

This comprehensive guide will simplify everything you need to rapidly get a replacement 147c letter. We’ll explain what the EIN verification letter contains, why you may need it, who can request it, and detail the fastest options to obtain your personalized 147c letter from the IRS.

So if you’ve lost your original Employee Identification Number (EIN) confirmation notice from the IRS and need another copy, you’re in the right place. Let’s dive in and demystify the entire 147c letter request process.

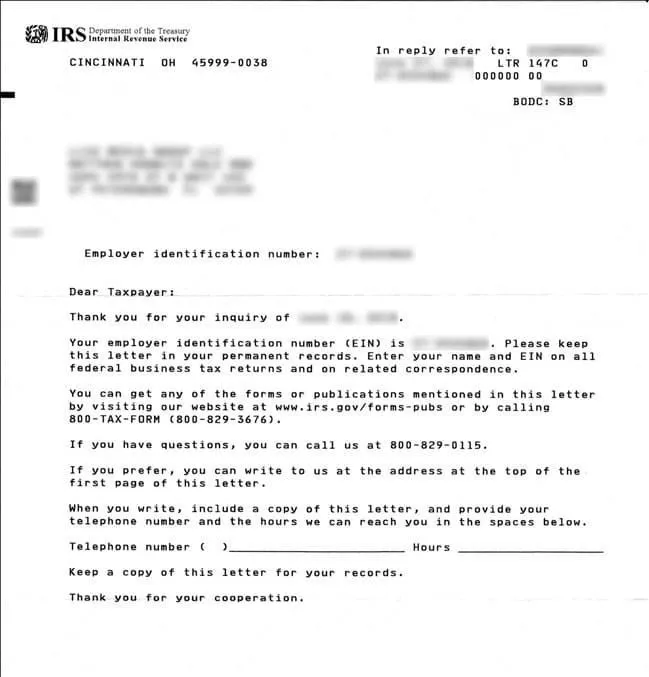

An IRS 147c letter, also referred to as an EIN verification letter, is an official document sent from the Internal Revenue Service. It displays your business’s assigned nine-digit federal Employer Identification Number (EIN).

This EIN confirmation notice also includes your business entity’s complete registered legal name and address listed in the IRS database.

Essentially, whenever you successfully receive a federal EIN for tax and identification purposes, the IRS automatically mails your business this 147c verification letter. It serves as formal proof and acknowledgment from the IRS that your corporation, LLC, partnership or other business structure secured an official EIN.

There are several important reasons you may need to acquire an EIN verification letter (147c) for your business:

In other words, despite having an EIN, many agencies and businesses will not formally recognize the legal status of your corporation or LLC without IRS-stamped validation. Whether opening a bank account, registering your company vehicle or simply proving your business life, expect to routinely provide a copy your 147c letter.

Only authorized owners or representatives can retrieve a replacement EIN verification notice from the IRS. Typically, this means:

Minority shareholders, unofficial LLC members, employees, contractors or associates generally cannot request EIN confirmation directly from the IRS. However, with proper permissions, these informal affiliations can still obtain the 147c letter through an authorized representative listed above.

If no principal owner or officer remains active in the company, registered POAs may still qualify to receive a 147c notice on its behalf. Either way, the IRS will only issue replacement EIN letters to verified identities authorized under the business’s official registration.

Now that you understand what the form contains and why you need it, let’s explore the fastest ways to get your hands on an EIN verification letter (147c) from the IRS.

The IRS provides three reliable methods to quickly obtain your replacement 147c notice: call them directly, utilize a POA, or request through a professional tax service provider.

Calling the IRS Business and Specialty Tax line is the simplest way owners and principal officers can directly request a new 147c letter:

As long as you pass the standard security checks, the agent can instantly fax your new 147c letter or place a mail request to your registered business address. Just inform them of your preferred method to receive the refreshed EIN confirmation notice.

Expect a faxed 147c letter within minutes or mailed verification within 5-7 business days. Remember, only owners or partners can directly call the IRS through this process.

If you cannot or prefer not to call the IRS directly, authorizing a Power of Attorney (POA) provides another path to securing your necessary 147c letter. Here are the step-by-step instructions when using an IRS-approved POA representative:

This approach allows someone to securely obtain your 147c confirmation on your behalf. Make sure to fully prepare your chosen POA representative in advance.

IRS 147c letter sample

Finally, specialized tax preparation firms frequently provide 147c letter retrieval services for businesses nationwide. Their IRS connections and specialized staff simplify the entire EIN verification process.

Although paid services can seem inconvenient, this hands-off approach requires no effort from you. Reputable providers like H&S Accounting & Tax Services can swiftly procure your refreshed IRS notice containing up-to-date legal business details.

Professional tax services also help correctly update any changed information with the IRS, guaranteeing your new 147c letter contains current company data. Their expertise ensures you receive a valid 147c suitable for all legal and institutional purposes.

In certain cases, tax experts may directly expedite letter requests through dedicated IRS processing channels not available elsewhere. This yields the fastest and most reliable 147c letter turnaround.

While costs vary between providers, paying reliable tax professionals removes all hassle getting your urgently needed EIN verification letter reissued correctly.

Outside of professional services, how long does it take to receive your EIN confirmation after placing a 147c letter request?

The good news is the IRS can instantly fax your refreshed letter minutes after approving an owner’s call or POA request. This electronic copy usually satisfies most needs requiring the EIN notice.

For a physical mailed copy, expect your official 147c envelope from the IRS within 5-7 business days after successful telephone or POA requests.

So if you need fast verification, request fax delivery and receive IRS confirmation of your EIN almost instantly. Otherwise, standard mail provides you an official document for more stringent bureaucratic demands.

Obtaining a replacement copy of your critical IRS 147c EIN verification letter is a quick and easy process. Now that you understand what this notice contains, why you need it, and how to request it, you can confidently prove and validate your registered business identification at any time.

Whether you handle the straightforward phone call directly or use a specialized service for convenience, the IRS makes retrieving your 147c confirmation simple and fast. With this guide’s help getting a refreshed letter, you can keep your company compliance and financial operations running smoothly.

H&S Accounting & Tax Services specializes in the accounting and tax needs of individuals, professionals and small businesses. Our expert accountants and CPAs primarily serve clients throughout South Florida, you can request a one-on-one consultation in person if you are located near Aventura, Cooper City, Dania Beach, Davie, Driftwood, Fort Lauderdale, Hallandale Beach, Hollywood, Lauderhill, Lauderdale Lakes, Margate, Miami Gardens, Miami Lakes, Miramar, North Lauderdale, North Miami, Oakland Park, Opa-Locka, Pembroke Pines, Pembroke Park, Plantation, Sunrise, Tamarac, and Weston. We also offer accounting and tax services nationwide remotely.